Our Ethos

A Level Path Into

Crypto-Currency.

Our Ethos

A Level Path Into

Crypto-Currency.

Traditional markets are familiar. Digital assets are not. Cyber Hornet was built to connect the two in a way investors and advisors can understand.

Join the swarm

Our Approach

our Principles

Discipline

Transparency

Familiarity

Accessibility

our Principles

The result is a structured, advisor-friendly framework for entering the digital age of investing without unnecessary complexity.

Our Experience

A New Buttonwood

Agreement

Agreement

This is our pact with investors: a level playing field, built for what’s next.

Leadership

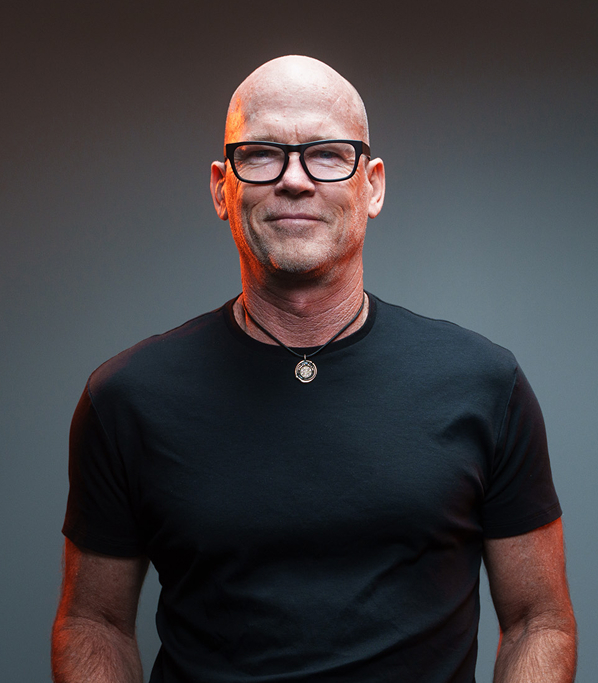

Michael Willis

Todd Johnson

Babak Keradman

David Hunt

Alyssa Young

Hudson Evans

Blake Williams

Matthew Bowie

Michelle Canete

Brent C. Kraus

Karenna Mingorance

Our Partnership with S&P Dow Jones Indices

CYBER HORNET ETFs are built on a foundation of trusted index construction.

A growing

family of etfs

CYBER HORNET’S expanding suite of ETFs applies a consistent framework across a range of digital assets, allowing investors to select their preferred exposure while maintaining a stable equity foundation.

BBB

SSS

EEE

XXX

ZZZ

Built for the

Long Term

Long Term